Monologue

Markets, macro, and geopolitics delivered an eventful week that left much unresolved. So, this week's Monologue is a buffet of thoughts and reflections around the theme of indecision.

Markets undecided on the AI bubble

Another week of whiplash headlines along the lines of "Stocks Drop on Loss of Confidence in AI Theme", "Markets Rebound on Blowout Tech Company Earnings," and "Nvidia's Post-Earnings Rally Fades After Bubble Fears Return" (that last one is real) leaves me increasingly convinced that we're finding the top of the market. I've said before that I don't see a major catalyst for a formal correction or bear market this year beyond Nvidia's earnings, which are now behind us and have triggered a sell-off but not a correction. That said, it's also getting difficult to list reasons AI-driven stocks can extend their rally meaningfully.

Fed undecided on interest rates

Perhaps the Fed can help. Markets responded warmly to New York Fed President Williams' dovish speech on Friday, limiting the week's losses. But the totality of recent Fed Speak and Wednesday's Minutes paint a picture of a deeply divided rate-setting committee, with the main question mark now hanging over Chairman Powell. I've always been sympathetic to the argument that some ambiguity enhances the potency of interest rate decisions (at the cost of some short-term market volatility). The Fed is positioning itself to test that theory in December and January if Chair Powell doesn't telegraph his thinking before then.

Data undecided on labor market

September's stale labor market data resolved nothing for the Fed. Hawks can point to stronger-than-expected job growth. Doves can point out that the unemployment rate rose anyway. The FOMC won't have a perfect picture of the economy heading into the December 10th meeting. We won't see CPI or PPI data for October or November until after that meeting, and September PCE, due next week, is well out of date. So the inflation picture remains incomplete. The same for employment: October and November jobs reports will be published shortly after the meeting, although alternative indicators do not suggest that cooling has accelerated (it's slowed down if anything).

Investors decided wrongly on European defense stocks

European defense stocks took a major hit after the Trump administration's harsh "peace proposal" for Ukraine was made public, with the STOXX Aerospace and Defense Index down -2.1% on Friday. Obviously, this puts some defense supply contracts at risk, but this strikes me as exactly the wrong reaction from markets. America's withdrawal of its defense umbrella and unwillingness to play the role of global hegemon mean that Europe must accelerate its self-funded re-arming. The implicit message in the US proposal for those playing the defense and security theme is short-term pain, long-term gain for European stocks. This dip looks like a potential buying opportunity.

The US-imposed deadline for Ukraine to accept the deal is November 27th (this coming Thursday). Several of Ukraine's red lines were violated in the proposal (the FT has a helpful annotated guide), so back-and-forth over the deal will likely drive significant volatility in exposed corners of the market this week. That could even bleed into the energy complex, although price action in oil and gas so far doesn't indicate markets expect Russia's imminent reintegration into the global order.

World deciding on Canada narrative

The jury may still be out locally on the investment-heavy growth agenda laid out in Canada's recent Budget Statement. Foreign investors, however, are responding well. The head of one of Europe's largest fund managers, EQT Group's Masoud Homayoun, who was accompanying a Swedish royal visit to Ottawa, lauded Canada's openness to foreign investment. Shortly after, Prime Minister Carney secured a $70 billion investment pledge from the UAE, starting with a $1-billion critical minerals deal.

Middle Market Undecided on Joining M&A Boom

In this week's Memo (see below), we point out that the much heralded M&A pickup is concentrated at the upper end of the market, where larger deals are being done. The bread-and-butter middle market is in much the same state as it has been since 2023.

Reads of the Week

The articles that have engrossed us.

- The Aftermath of the Pandemic Retirement Boom: Labor force participation among Americans aged 65+ fell during the pandemic and never recovered. As the population ages and immigration falls, productivity growth becomes crucial to maintaining potential output.

- The Warning Signal from Bitcoin's Fall: Katie Martin at the FT has figured out what Bitcoin is actually good for (one level up from "absolutely nothing").

- Trump White House Prepares Tariff Fallback Ahead of Court Ruling: The Supreme Court can slow tariff implementation and potentially limit the White House's scope to impose them unilaterally, but the administration has alternative means to keep most of their import taxes in place. This will likely end up prolonging trade-related uncertainty.

Market Monitor

Topsy-turvy equity action dominated the week. Blowout Nvidia numbers should have soothed investor nerves on AI. Instead, they triggered one of the wildest trading days of this year as tech stocks came under heavy pressure. The durability of the AI narrative is being questioned, and this week's dips were exacerbated by liquidity and increased shorting activity.

The end result after much see-sawing was the S&P 500 falling -2.0% for the week and the Nasdaq down -2.6%. The S&P 500 is now -4.2% off the end-October high (an official "correction" is usually defined as a 10%–20% decline).

Let's touch on those Nvidia earnings, which were impressive even relative to inflated expectations. The chip-maker announced sales forecasts of $65 billion in the January quarter (up 62% and $3 billion above analyst consensus) and commentators now think that its half-trillion dollar revenue outlook in "coming quarters" (we're not sure how many) is looking conservative. If those numbers led to a sell-off, the event that markets should really fear is the inevitable quarter when Nvidia has to guide analysts down.

Sentiment measures tell a very different story from Nvidia's numbers. The CNN fear/greed index has dropped into "extreme fear" territory, and the US bull-bear spread stands at -11%, as low as it's been since April. These conditions point to further pressure on equities, but the dip-buyers have the weekend to assess their response.

The macro complex also indicated loss of confidence in the global outlook. Treasuries rallied against sovereign peers, and the DXY US dollar index gained 1%. Corporate spreads widened across the board. Both gold and oil prices sagged.

Commodities may have received a shot in the arm from a G20 resolution on critical minerals cooperation. That hasn't shown up in the macro numbers though —the S&P GSCI Industrial Metals index dropped a full 2.7% this week amid the generally bearish sentiment.

Macro Monitor

The key U.S. and global data and events this past week:

- Nonfarm payrolls, September (United States): +119k (previous revised: -4k; consensus: +50k)

- Unemployment rate, September (United States): 4.4% (previous: 4.3%; consensus: 4.3%)

- Manufacturing Flash PMI, November (Global): 50.2 (previous: 49.6)

- Services Flash PMI, November (Global): 50.5 (previous: 52.3)

Federal agencies have started catching up on the backlog of outstanding data. As expected, we're getting the stale releases first. September's jobs report differed slightly from expectations, but not enough to change anyone's perception of the labor market (which continues its gradual cooling). Employment growth exceeded expectations, partly offset by downward revisions to July and August. Unemployment rose by a tiny fraction—just enough to push the rounding up +0.1 percentage points to 4.4%.

A bright spot in an otherwise dark week: Manufacturing PMI returned to mildly expansionary territory in the November release.

The biggest macro news came in the form of talk, not data. The Minutes of the Fed's October meeting revealed deep fissures within the rate-setting committee, leaving markets split on the prospects of a December cut. That changed Friday when a key voice among swing votes—New York Fed President John Williams—came out in favor of a cut. Pricing now indicates 70% odds of further easing in December. We've yet to hear from Chairman Powell, who hasn't spoken since he made some relatively hawkish comments shortly after the October meeting. With no meaningful data due before December 10th, we still think prudence demands a pause (note that opinions are not forecasts).

While we're on the topic of macro, don't miss the latest Tangents post (free to all readers, so please share it) titled "Error of Margin," in which we looked at what different measures of corporate profits are (and aren't) telling us about how firms respond to tariffs and their macroeconomic impact.

See the appendix for the top macroeconomic indicators tracking chart

What we'll be watching next week

- US delayed September data releases (Tuesday & Wednesday): Consumer expenditure and PCE inflation are probably the most interesting of the stale data due this week. We'll also see Retail Sales and PPI.

- Canadian Q3 GDP (Friday): We're only flagging this because a negative number would indicate an "official" recession (two quarters of contraction). Consensus calls for a narrow escape (+0.3% QoQ).

Memo

The K-Shaped M&A Recovery

Bottom line: The M&A boom is more about mega-deals than a broad-based surge in deal making, leaving the middle market segment of the PE industry that serves the global Main Street out in the cold.

Much has been made of the K-shaped consumer economy, where the top end of the income distribution drives overall personal expenditures while lower tiers stagnate.

The analogy extends to the stock market, where a handful of stocks (the Magnificent Seven or "AI Hyperscalers") drive the S&P 500 while the bulk of the index has delivered unimpressive returns in 2025.

We've found that the "K-shape" applies to the much-heralded pickup in M&A activity as well. This is driven by deregulation and a more lenient antitrust enforcement in an era of Republican dominance in the US, alongside easy financial conditions—as captured by our arcMacro Financial Factor, which is currently half a standard deviation more accommodative than the historical norm.

Let's establish some facts about the pickup, bearing in mind that all data in this section covers confirmed deals with known valuations, making it directionally correct but an underestimate of actual activity (inevitable in opaque private markets). Extrapolating October data through year-end, capital markets are in for a bumper year. Public markets have seen rising IPO and secondary activity, with global capital raised running at $370bn this year—the highest since 2021.

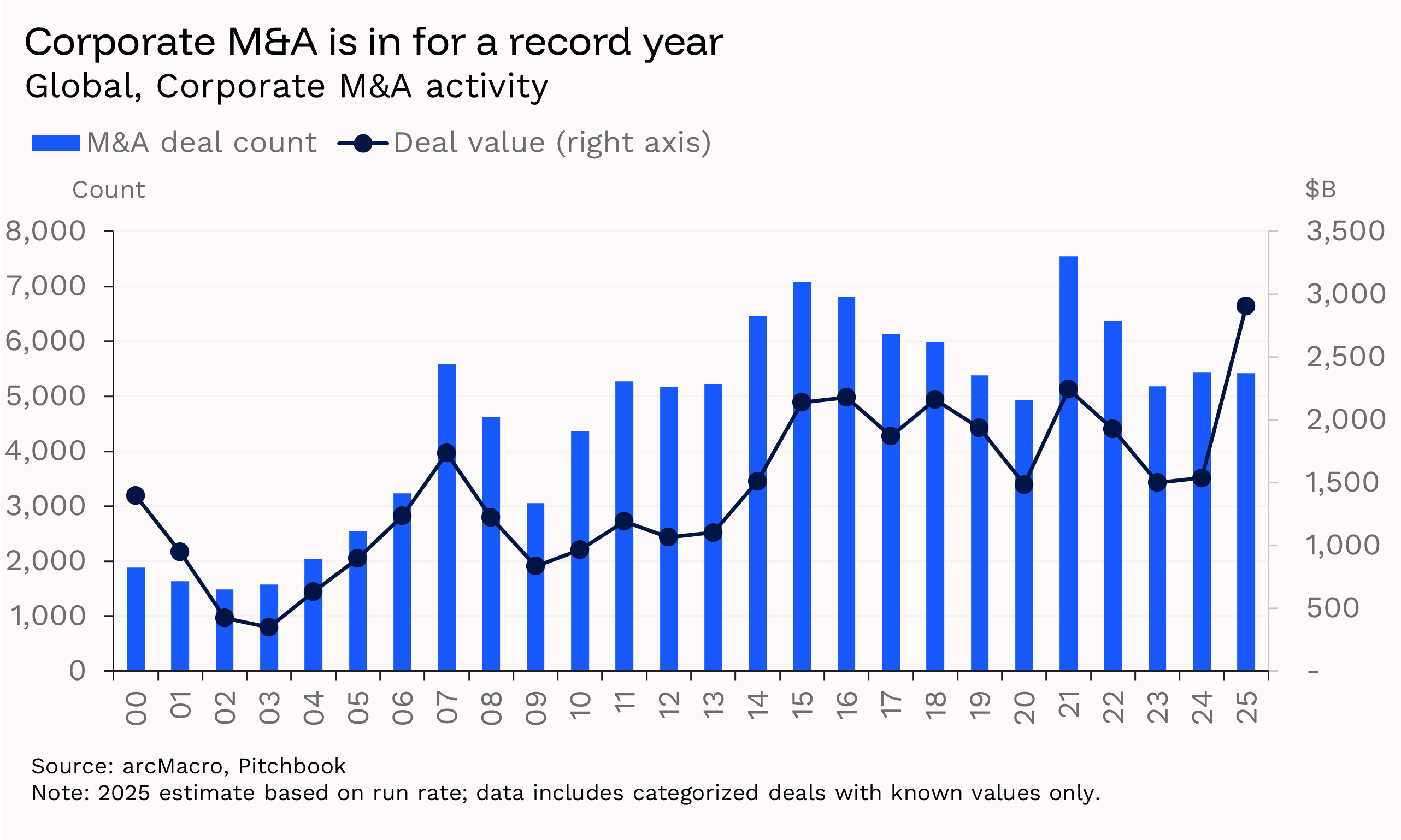

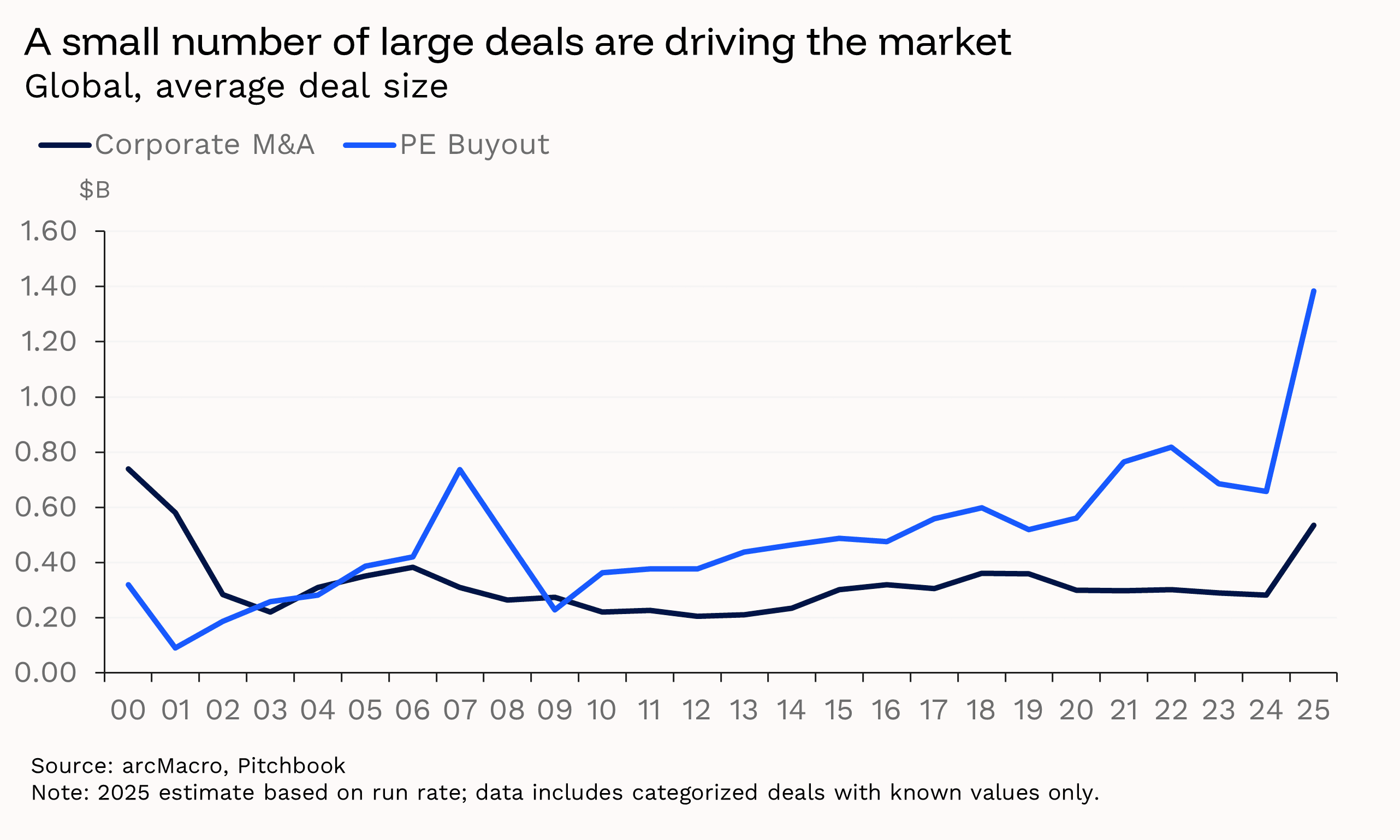

Corporate M&A is having an even more impressive run, on track for nearly $3tn in global deployment. That's almost twice the 2024 number and easily a historical record. But that's coming off a volume base remarkably similar to 2023 and 2024. Larger deals are the sole driver of increased capital deployment.

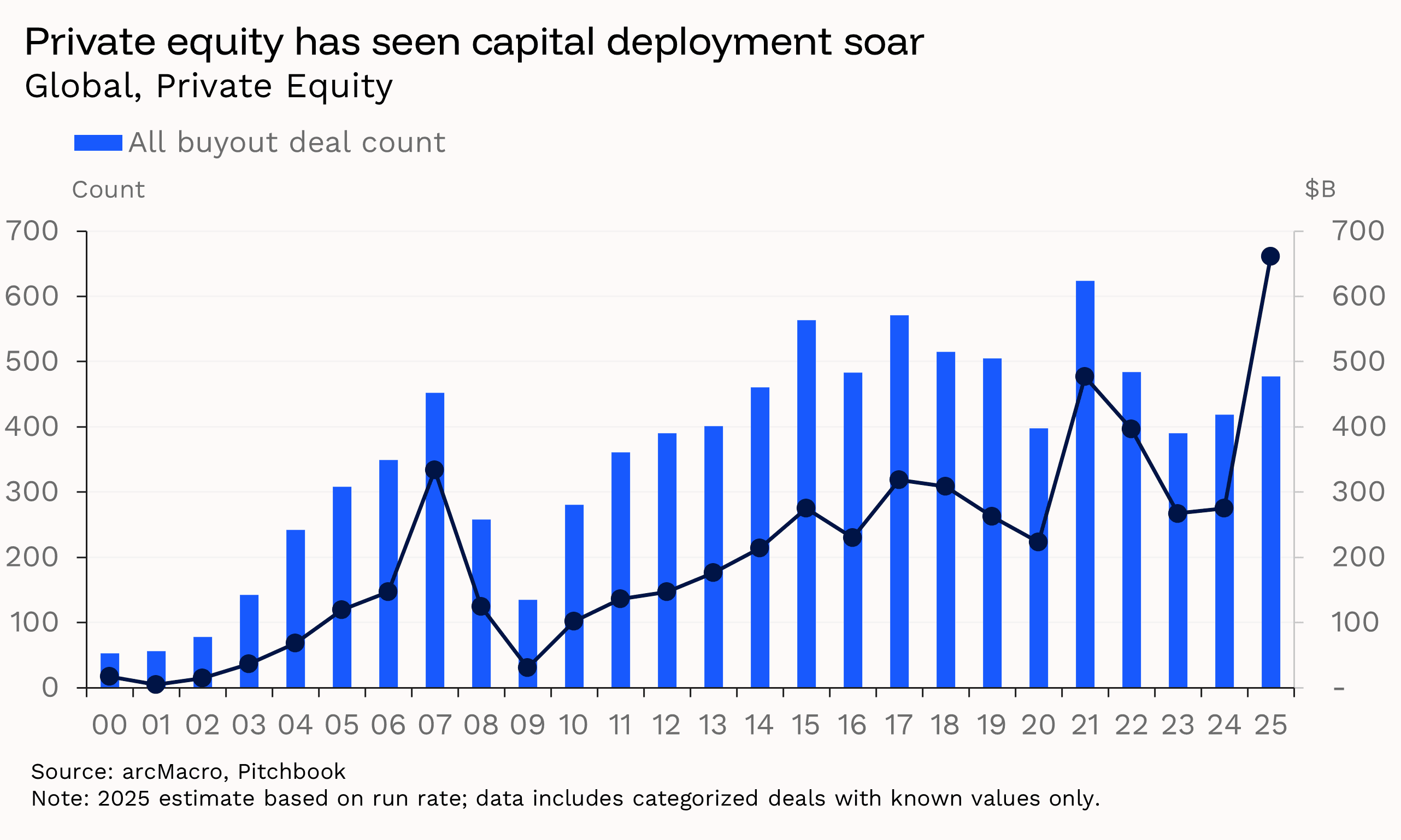

The trend is even more extreme when we narrow in on private equity transactions. Capital deployed through leveraged buyouts—including secondary buyouts, where one private equity firm purchases controlling stakes from another—is on track to break above $650bn, up from $276bn in 2024 and 25% above the prior record set in 2021.

Again, however, this is a story of large deals driving the trend. We're only on pace for the seventh-best year on record by deal count. Although more capital is being deployed, PE professionals aren't any busier than usual.

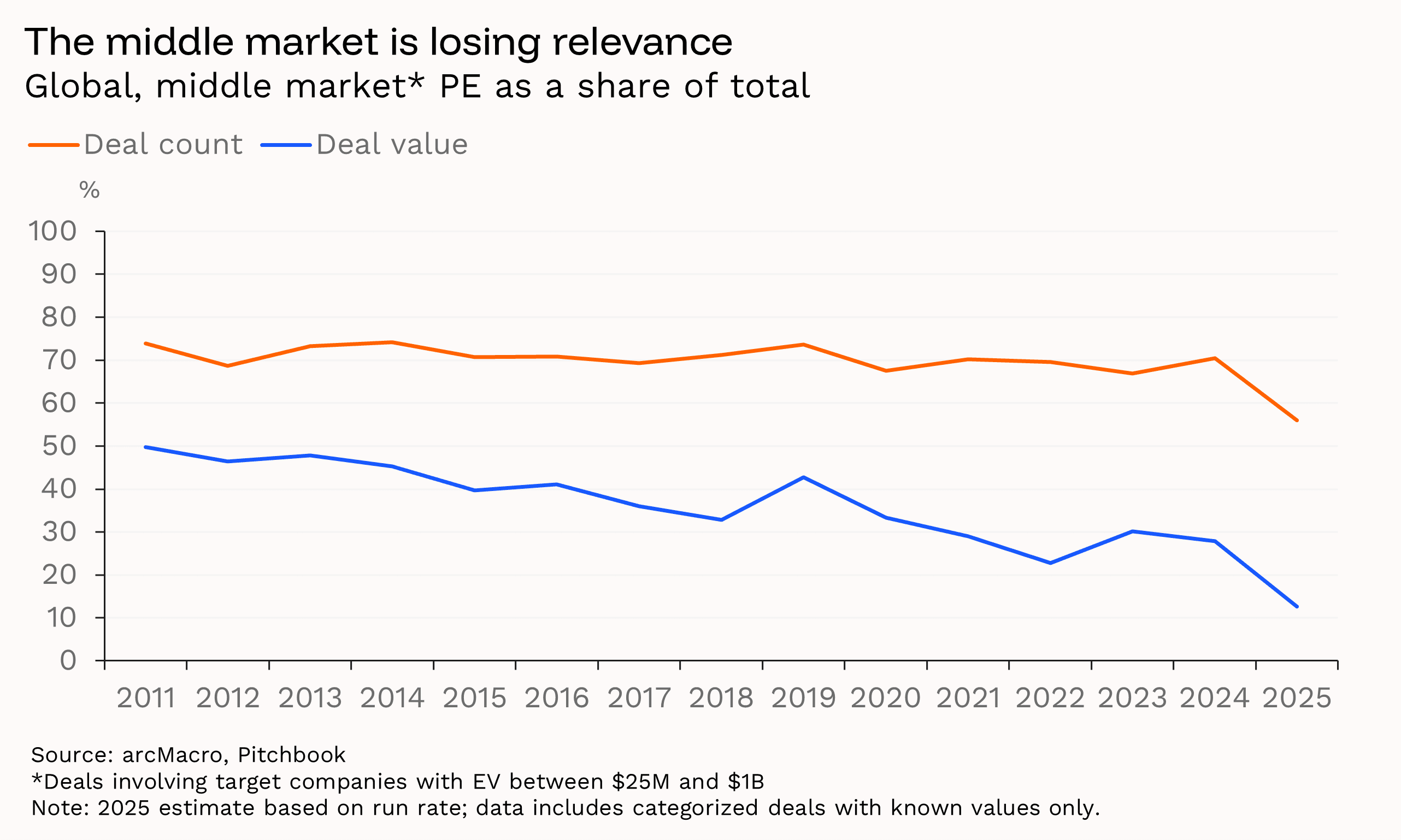

This trend toward larger deals affects the structure of the PE industry. The middle market—deals between $25m and $1b, which targets the bulk of firms in the economy and is where PE makes its strongest case for creating socioeconomic value—is losing relevance. This segment has fallen to ~12% share of deals, from 30% in 2023 and 2024. Underlining the weakness, the proportional deal count is down too, below 60% of all deals for the first time ever this year.

Prices play a role (elevated valuations raise average deal prices by definition), but the spike in average deal size and falloff in the middle market is larger than expensive valuations alone can account for. We're seeing evidence of continued strain that hasn't really let up since 2022, when spiking inflation and interest rates stopped the party. The problem now is that funds are still struggling to offload assets profitably, stalling the cycle of fundraising and renewed deal activity.

The overall macro implications are mixed. On one hand, the M&A recovery isn't as broad or durable as face values suggest; that's clear. Mid-market PE, in particular, isn't out of the woods and, in our view, still requires a valuation reset to accelerate. On the other hand, there is one big silver lining: the historical tendency of M&A to peak before a crisis (pre-dotcom crash, pre-GFC) might not apply this time, because there isn't an economy-wide pickup in leverage underway. Instead, activity is relatively normal while a small set of super-deals are pumping the aggregates.

Appendix 1: Key Macro Indicators Tracker